AWFIS, 5th floor, Ambience Mall, Gate No. 03 & 04, Ambience Island, NH-84, Ambience Mall Gurgaon 122002

What are we trying to convey through this data?

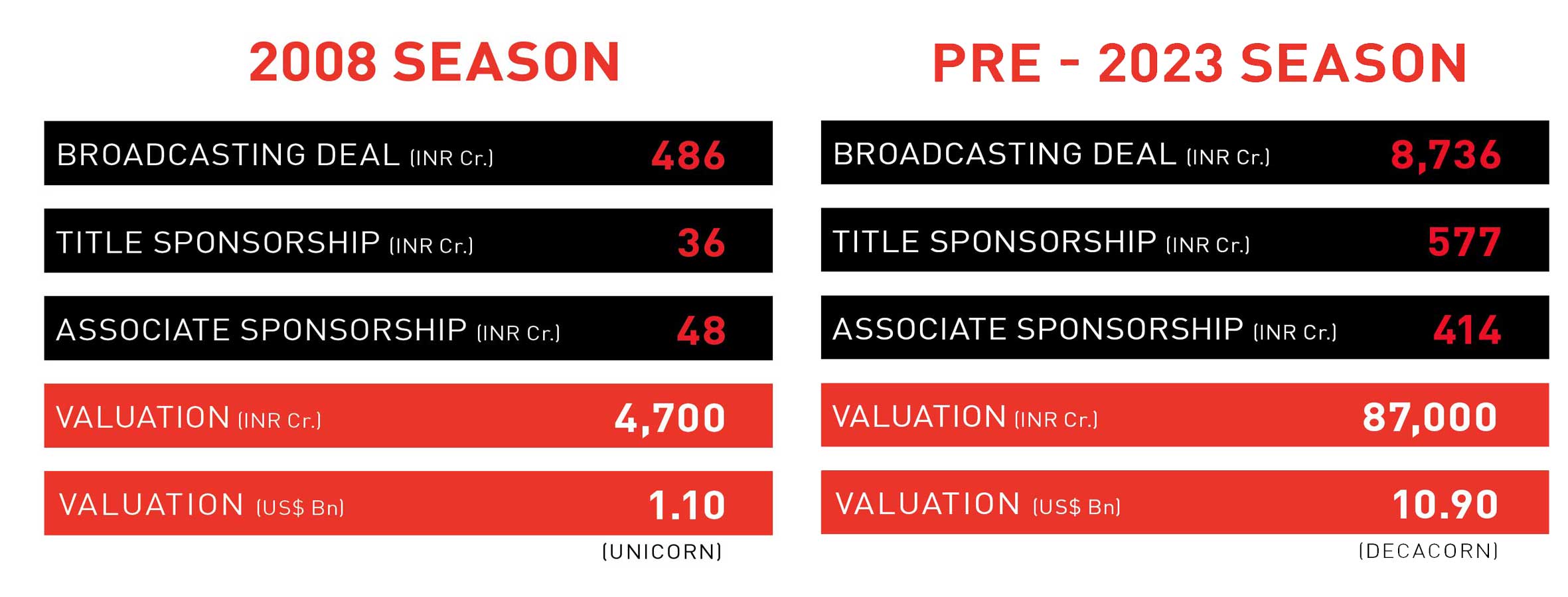

IPL has become a global phenomenon since its inception in 2008, with a significant increase in its ecosystem value. The infographic highlights the key valuation drivers of the IPL ecosystem, which include per season media rights, title sponsorship, and the associate sponsorships. More than 80% of the ecosystem inflows can be attributed to these factors alone and this is expected to continue in the immediate future.

Media Rights have emerged as the most significant source of revenue for the IPL. The league’s ability to attract large viewership and engage fans has helped it to command premium prices for its media rights. As the number of matches has increased over the years, the total value of media rights has also gone up significantly.

The other significant valuation driver is the Title Sponsorship. The league has been successful in attracting top brands as title sponsors, which have helped to increase its visibility and credibility. The value of title sponsorships has also grown significantly over the years, as more and more brands have shown interest in associating with the IPL.

Not to be left behind are the Associate Sponsorships. The league has been able to attract a wide range of associate sponsors, including brands from various industries, which has helped to diversify its revenue streams.

Overall, the IPL ecosystem has demonstrated remarkable growth over the years, driven by its ability to attract top talent, engage fans, and create a valuable brand.

The broadcasting rights are sold to TV broadcasters and streaming platforms, and the revenue generated from these deals contributes significantly to the IPL’s overall value.

The title sponsorship is sold to a brand that pays a substantial amount of money to associate its name with the tournament.

Associate sponsors are typically not the title sponsor, but they still have a significant presence in the tournament through various branding and advertising opportunities.

Comparing the current value of WPL with current value of IPL

It would be unreasonable to compare the current value of WPL with the current value of IPL. Comparing the WPL current valuation with the value of the IPL in 2007-08 would make more sense. But it should be noted that the WPL is currently played with only five teams, whereas the IPL had eight teams initially. Also, the media rights and title rights for WPL are lower than the equivalent numbers for IPL at inception. This makes it difficult for the WPL to command a valuation similar to that of the IPL in 2008. However, the WPL is expected to show steady growth in terms of viewership and fan engagement, and with the right strategies and investments, it could become a significantly more valuable property in the future.

What is the process followed to arrive at this data?

To estimate the IPL ecosystem values for years prior to 2014, we have conducted a regression analysis using publicly available/ third party historical data for select years. Specifically, we identified a set of underlying drivers that we believed were most closely related to the IPL ecosystem values, such as media rights, title sponsorship and associate sponsorship.

Data was collected for these drivers for several years and used in conjunction with risk factors to develop a statistical model that estimated the relationship between the drivers and the ecosystem values. The statistical equation was used to predict the ecosystem values for years prior to 2014.

The resulting estimates of IPL ecosystem values and its underlying drivers have been presented in the form of an infographic, to provide a visual representation of the trends and patterns we observed. It is important to note that while the regression analysis can provide useful insights into the relationships between variables, it is not without limitations, and the estimates produced by our model should be interpreted with caution.

Disclaimers to the analysis

The infographic publication on IPL ecosystem values over the years and its underlying drivers is prepared by D & P India Advisory Services LLP (“D&P”) and intended for informational purposes only. The data and information presented in this publication are based on publicly available sources and are subject to change without notice.

D&P has taken reasonable care to ensure that the information contained in this publication is accurate and up to date. However, D&P makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information contained in this publication. D&P disclaims any liability or responsibility for any loss or damage that may arise from reliance on the information contained in this publication. Users of this publication are encouraged to conduct their own research and analysis and seek professional advice before making any decisions based on the information contained in this publication. D&P does not endorse or recommend any particular course of action or investment strategy, and this publication should not be construed as an investment advice or a recommendation to buy or sell any securities or financial instruments.

The IPL is a complex ecosystem with multiple stakeholders and factors that influence its performance. The information presented in this publication is intended to provide a broad overview of the IPL ecosystem and its drivers and should not be considered comprehensive or exhaustive. D&P reserves the right to modify or update the information contained in this publication at any time without prior notice.

Read about our study here..

The Editorial Team

In case you are interested in getting more details about the analysis,

we request you to reach out to

*Source – Data from year 2014 – 2020 – Kroll Valuation Report